The clientele of California’s failed Silicon Valley Bank (SVB) was the high tech start-up industry in Silicon Valley. Banking is a con industry. Without the confidence of depositors, no bank is solvent. This was what SVB faced. Some of its depositors withdrew their deposits to gamble on risky, high-interest rate stocks. The bank did not have enough liquid cash to honour this request. The remaining depositors were left short.

The US government knew if it did support the bank depositor/investors, it could not be publicly called a “bail-out.” Why not? The term bail-out “had become a toxic word in the wake of the 2008 financial crisis. The depositors would be protected, but the bank’s management and its investors would not.”

The March 2023 bailout was for the full amount – not simply the $250,000 normally protected by the Federal Deposit Insurance Corporation (FDIC), the banking regulator. These rich depositors were ‘bailed out’ by the US government in full. This includes Pieter Thiel, the multi-billionaire.

Jamie Dimon, chief executive of J.P. Morgan — when asked for his advice by the Biden administration’s Deputy Secretary of the Treasury — warned of “potential” for the banking crisis to spread to other banks in a “cascading series of bank failures.” And indeed the cryptobank Signature Bank was also at risk of crashing soon after and was taken into receivership by the government (US speak for temporarily nationalised).

What happened? Clients had deposited their cash in SVB to reap profits with the bank’s investment strategy. That was locked into US government fixed, long-term bonds, which yielded stable returns. Profit-seeking capitalists realised however that there was a catch in the post-COVID era as inflation re-emerged.

This resulted from an increase in the money supply following the government pumping money into businesses, but also to the population during the pandemic. Between them, the Trump and Biden administrations put into the economy over $5 trillion (“almost a quarter of GDP”) of which $1.8 trillion went into households.

It is true that in the current inflation phase, other non-monetary causes of inflation operate. These include poor supply chains exacerbating supply and demand mismatches, employers wishing to squeeze wages, and businesses using the situation to gouge prices. But there was an undoubted major increase in the money supply.

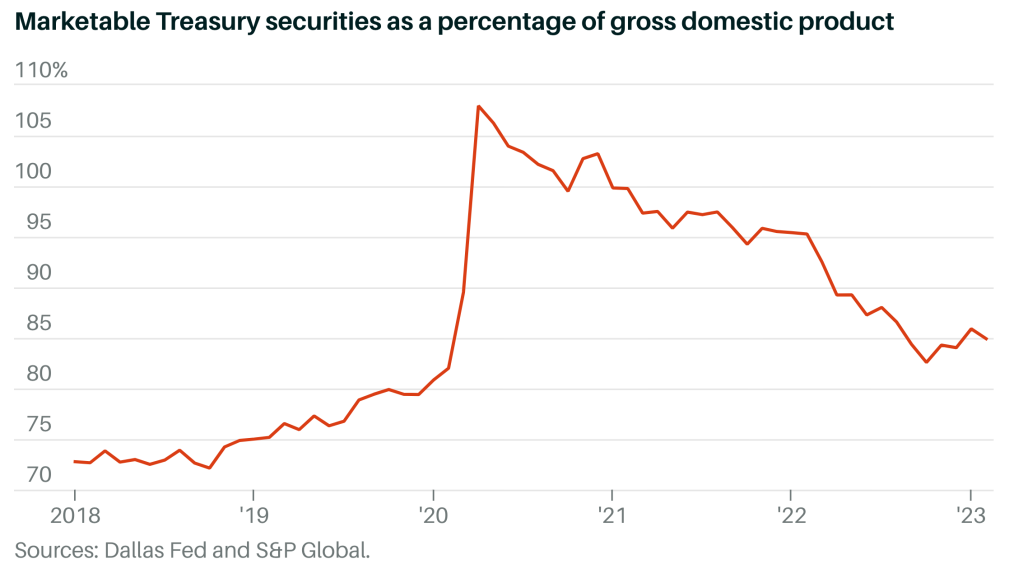

Attempting to control this money supply, the central banks reverted to their traditional “solution” of raising interest rates. This makes the commodity of money more expensive to buy. As rates steadily rose, the profits from fixed, long-term government bonds (or Marketable Treasury Securities) fell below those obtained by shorter-term bonds or pure speculative gambling. That led investor/depositors to start withdrawing their deposits from SVB. They switched that capital into lending money for shorter term but higher interest rate loans. The search for “fictitious money profits” – as Marx put it – once more led investors to shift money around in search of extra profit increments.

The same dynamic for the lowered profits on long-term Treasury bonds applies also to other so called “fixed income” bonds. It appears that in total some $2.2 trillion are “over-valued” currently, a looming threat destabilising the economy and many exposed banks.

“Other fixed-income markets like the $12 trillion mortgage-backed securities market and the $10 trillion corporate bond market also saw big losses in market value. This is a key reason why banks, which hold such securities, are currently under stress. A recent study found that such assets in the U.S. banking system are overvalued by $2.2 trillion due to mark-to-market losses.” See David Beckworth’s analysis: “The Fed Has Overseen a Remarkable Transfer of Wealth From Bondholders to Taxpayers.”

Actually the amount of holdings by Banks of such “fixed income” markets has soared between 1980 to 2023 from about $0.5 trillion to $6 trillion.

There is another feature of what has happened that we should note: the effect of the rising interest rate has also been to diminish the so-called Debt to GDP Ratio. This is shown below, expressed by the amount of ‘Marketable Treasury Securities’ held as a percentage of GDP.

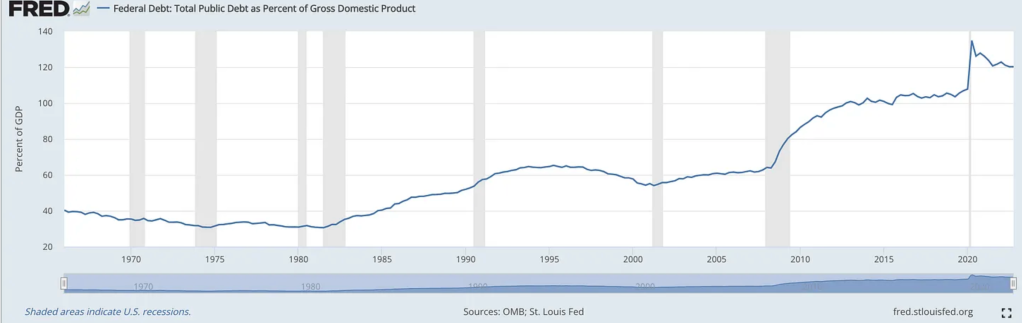

This is a very new phenomenon as Adam Tooze points out. His depiction from Federal data from the years 1970-2023 makes that case:

This took hold from the post-pandemic period from 2021. The consequence of this is that government public debt has fallen dramatically. We have discussed previously the divisions of interest between banking and financial capital and industrial capital, which remain intense. At the core is an enthusiasm for high interest rates by finance capital, which gains from the higher rates of borrowing capital. But this is contradictory to the interests of the industrial capitalist who borrows capital for reinvesting in new technology and means of production, therefore preferring a lower interest rate.

Ultimately the contradictions of capital continue to grow immensely. Marxists understand that the whole international banking system under capitalism is – like all other features of capitalism – incredibly fragile. Three points can highlight this.

First in the US, in emergency moves the government established a “Bank Term Funding Program” to underwrite banks. This defends them against depositor withdrawals by using government loans against their original purchase of long-term government bonds, because the government knows that many banks in the US are “underwater.” What this means is they hold large stocks of government bonds that have lost in value as compared to short term “risky” betting investments. That is termed “unrealized losses.” On top, the capital the banks hold frequently cannot cover sudden withdrawals – about 10% of banks have less capital than SVB did. The total unrealized losses at US banks is estimated now at $620bn, or 2.7% of US GDP.

Second, this is not a phenomenon restricted to the United States – it is international. For example, the collapsing confidence in the 167-year old Credit Suisse Bank forced a take-over at basement-low prices by its long time rival, Swiss UBS. But UBS demanded that the Swiss government guaranteed it against potential losses on the books of Credit Suisse, providing $100 bn in liquidity funding to cover deposit withdrawals.

Third, potential solutions such as bank regulations have been weakened, such as the Glass-Steagall Act of 1933. As we pointed out previously, this was weakened by the Democrats and Republicans together — but apparently not enough for financial investor greed. Even the International Monetary Fund (IMF) despairs of meaningful regulations. Its diplomatic language notwithstanding, it concedes “regulations” are not effective: “As the financial system continues to evolve and new threats to financial stability emerge, regulators and supervisors should remain attentive to risks… No regulatory framework can reduce the probability of a crisis to zero, so regulators need to remain humble.”

Normal mechanisms such as lowering real incomes by inflation and removing any vestiges of a “welfare state” are not enough to satisfactorily balance the competing pressures. Meanwhile leading capitalists hope for newer territories and work-forces to exploit. These ambitions are steadily leading to a new world war. Workers and toilers of the world must organize to frustrate this path. Only a workers’ and toilers’ revolution can succeed in this goal. This requires Marxist-Leninist parties, which are being built in many countries.

This article originally appeared in ‘American Party of Labor